Why the M&A Dam Breaks in the 1st Half of 2025

While a laundry list of headwinds has reduced M&A deal activity to levels not seen for nearly 10 years, all signs point to a robust resurgence, starting in the 1st half of 2025. Per one of the founders at Thoma Bravo commenting late last year, the M&A dam should break sometime in the 1st half of 2025. Here are a few reasons why:

On the Demand side:

PE funds are sitting on $1.2 trillion of dry powder, of which 26% is greater than 4 years old, and generally GP/LP commits are tied to 5-year commitments, which means either funds deploy such monies or lose 26% of their allocation

The Fed has begun cutting interest rates and will continue in 2025, allowing for cheaper cost of capital to acquire business

Additionally, once banks start loosening their purse strings, LTV (loan to value) and Debt/EBITDA or ARR should start to increase as well

Once funds start exiting their portfolio companies and delivering liquidity to LPs, LPs are more likely to re-up into new funds, providing fresh dry powder for funds to deploy, increasing demand

S&P and Nasdaq are both up 12% and 14% respectively, allowing public companies to utilize their public equity as currency to acquire companies

On the Supply side:

PE funds having been delaying selling their portfolio companies until markets and individual companies have rebounded, along with rates declining. This foot dragging is evidenced by the $3 trillion in PE-held assets approaching 5-year holds, which funds generally have agreements with LPs to return capital within 5-7 years of deployment.

As stated by Bain, this should necessitate a wave of exits in the near term

Assuming returns are decent and by decent meaning greater than the risk-free rate, this allows for a better fund-raising environment, LPs should re-up, funds can raise new funds, and start deploying capital more aggressively

~$300 billion in leveraged loans are coming due by the end of 2025. Companies either have to refi (which is challenging with higher rates and more conservative debt covenants), restructure the debt, or exit the business

To this point, funds have been mostly restructuring debt and thus kicking the can down the road due to the poor market conditions. With healthier M&A market conditions, exiting becomes a lot more palatable

In the past few years companies have focused on improving profitability or risked going out of business due to the poor financing markets. Increased EBITDA and EBITDA margins only make for a more attractive and higher-value exit

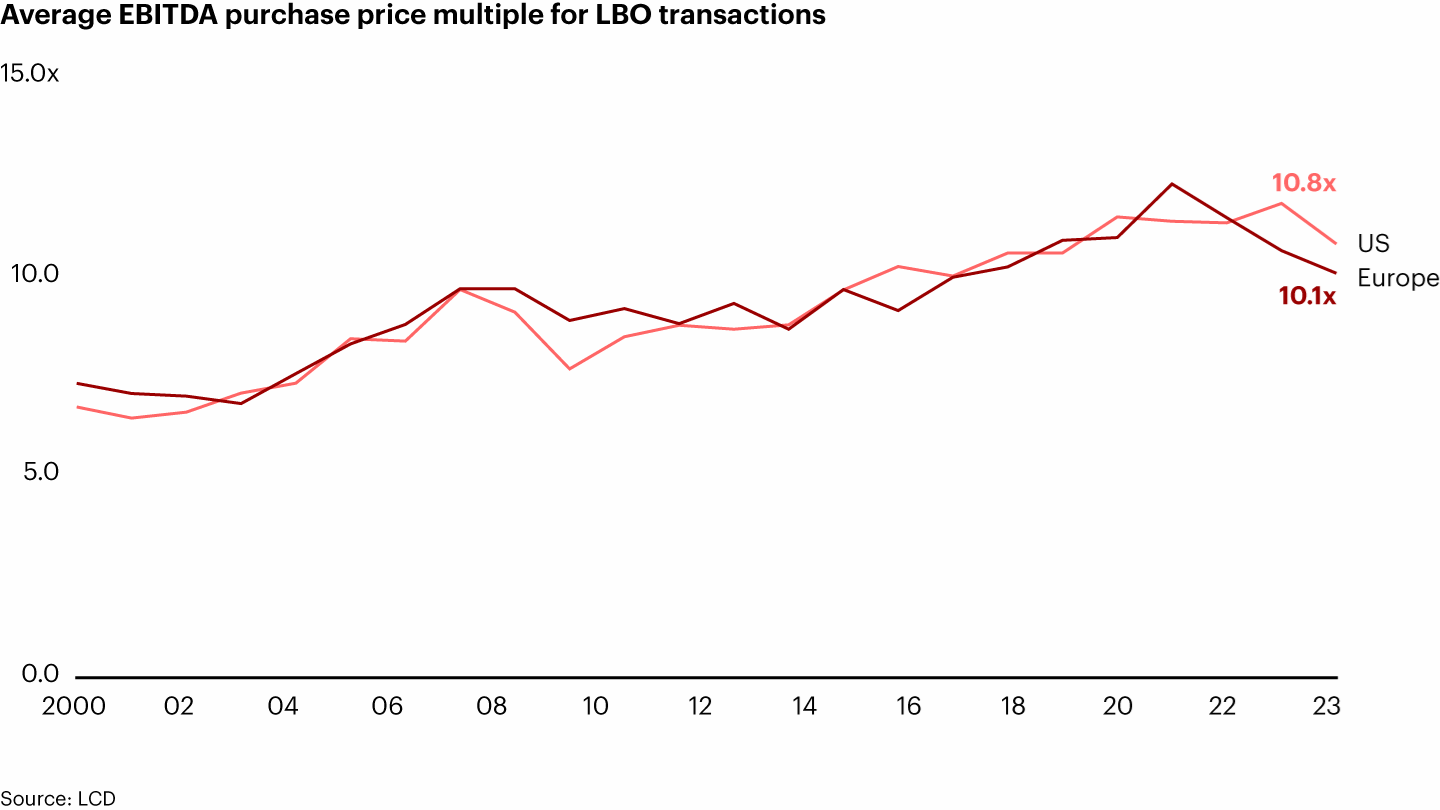

While multiples have understandably declined since the peak in 2021, there appears to be a narrowing of the gap between the bid and the ask. I expect a stabilization of the average EBITDA multiple in 2025

In conclusion, there exists a confluence of factors that should spur M&A activity starting in the 1st half of 2025, namely the older dry powder needing to be deployed, coupled with projected rate cuts. On the supply side, funds have to start exiting older holdings, which provides liquidity to LPs, and allows them to reinvest back into PE, replenishing dry powder, and increasing the demand even further. I can’t wait to see how this unfolds.

Reference: https://www.bain.com/insights/private-equity-outlook-liquidity-imperative-global-private-equity-report-2024/# https://www.bain.com/insights/when-the-dam-breaks-on-tech-deals-with-thoma-bravos-holden-spaht-podcast/?utm_source=substack&utm_medium=email