CANARY IN THE COAL MINE ON A POTENTIAL RECESSION: CLOUD AND SAAS SPEND IN 2022 AND 2023

Tech stocks are in the toilet, mortgage rates have doubled in the last few months, and used cars prices are through the roof. However, unemployment is still very low, and companies are still generally performing well and growing; so it’s unclear if we’re in a recession, we’re going to be in a recession, and if so, when? Or is this a another blip where we should see things returned to normal by year end, and wish we would have bought more dips in the market? While none of us have a crystal ball, a key leading indicator for B2B technology companies is SaaS and Cloud spend by enterprises for the balance of 2022, and into 2023. Despite the brutal last few months in the market and overall bearish sentiment, Gartner research from April shows enterprise SaaS/cloud performance is expected to remain very strong over the next two years. Specifically total Cloud spend is expected to grow 20% this year to ~$500b and more importantly, projecting to grow even faster into 2023, by 21%, to ~$600b!

Now, perhaps we’re early in flushing this government-induced economic pain through the system, and the economic domino effect is in its infancy, however with the latest inflation data showing a deceleration, and the latest fed remarks projecting modest future rate hikes, this balancing act of beating up the economy in order to lower inflation seems to be working, where inflation should continue to decelerate. It also begs the question, how much of the $600b of cloud spend is already budgeted, and viewed as too mission critical to trim? How much of this spend drives efficiencies and or revenue generation for customers? While the above chart is from a month ago, up until recently the folks in my network who are B2B software and cloud consultancies haven’t seen any slowdown whatsoever, even though they all are holding their breadth amidst the macro turmoil. Many are growing 50-100% driven by the continued growth of their SaaS & cloud vendor partners.

To build further on the mission critical and or efficiency question, see commentary below from a Gartner analyst:

“Cloud is the powerhouse that drives today’s digital organizations,” said Sid Nag, research vice president at Gartner. “CIOs are beyond the era of irrational exuberance of procuring cloud services and are being thoughtful in their choice of public cloud providers to drive specific, desired business and technology outcomes in their digital transformation journey.”

Related commentary from Jason Lemkin at SaaStr:

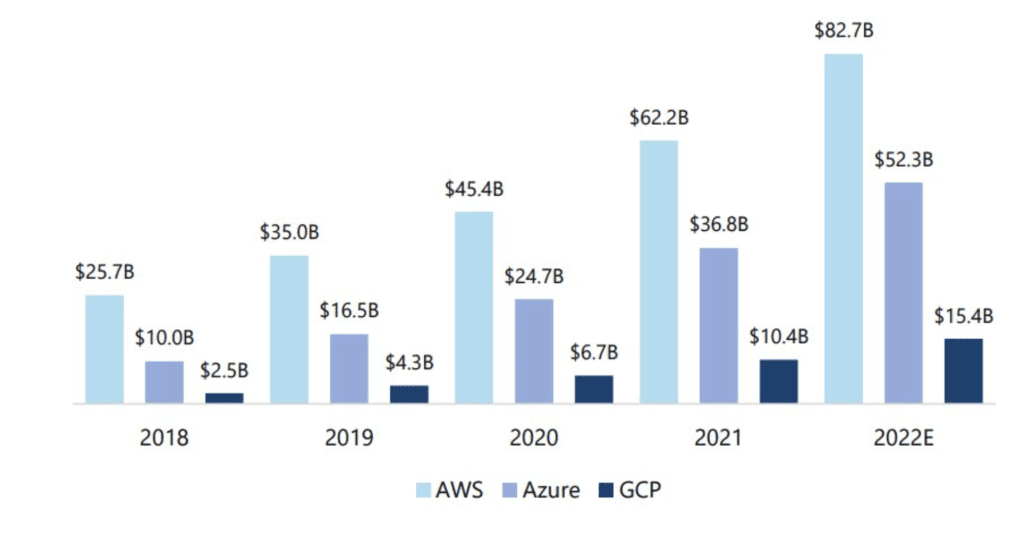

“Let’s look a whole level up to the real canaries-in-the-coalmine: AWS, Azure, and Google Cloud. They are the Cloud. And they are the CIO’s office and the CIO’s spend.

So if they are stumbling and slowing down, that’s a super worrisome sign. And if they are growing as fast or faster than ever — that’s as good a sign as it gets for SaaS and Cloud.”

And the answer, at least for now, is they are growing faster than ever, at massive scale in Q1’22:

Azure grew the fastest, accelerating to 46% year-over-year growth and they’re projecting 47% in calendar Q2’22. Microsoft’s Cloud business overall crossed a stunning $100B run-rate.

Google Cloud grew 44% last quarter to a stunning $25 Billion run-rate. Not bad for #3!

And AWS grew 37% at a $74B run-rate, down a bit from 39% the prior quarter but still adding an insane amount of new revenue.

In addition to cloud being a key bellwether of the health of B2B tech, SaaS is also viewed as a top priority for enterprises.

“SaaS remains the largest public cloud services market segment, forecasted to reach $176.6 billion in end-user spending in 2022.”

With this in mind, and right on cue, Salesforce delivered a quarterly earnings beat yesterday and provided strong guidance. Specifically, Marc Benioff mentioned “We’re just not seeing material impact on the broader economic world that all of you are in”. Many stock analysts feel the recent performance and outlook of a juggernaut like Salesforce to be a barometer for the broader enterprise SaaS and cloud market.

On the flip side, one customer segment that concerns me, that will definitely be a headwind in the coming years, are VC-backed start-ups that have been raising huge rounds at insane valuations, driving artificial growth, which includes SaaS and cloud spend. As the VC markets continue to tighten, the growth of such companies will similarly tighten as well, reducing growth of SaaS/cloud spend (most SaaS products have user-based pricing, so as hiring slows, so does SaaS spend). It’s unclear how much of the $600b of projected spend comes from this category; I would assume a single digit percentage that doesn’t move the needle yet we shall see.

So while we can continue to speculate and get caught up in the volatility in the markets as well as macro headwinds, the facts show continued strength in overall cloud adoption and growth for years to come.

Source: Gartner

Source: Saastr